Introduction to Mud Pump Liners

Mud pump liners serve as critical components in oil drilling operations, protecting pump systems from abrasive drilling fluids while maintaining hydraulic efficiency. This section explores their fundamental roles and operational significance through two key perspectives: core functions in sealing and wear protection, and their impact on drilling safety and economics.

Definition and Core Functions

Mud pump liners are cylindrical sleeves installed within mud pump cylinders, acting as sacrificial barriers between pistons and abrasive drilling fluids. Their primary functions include:

Pressure Containment:

- Create sealed chambers to maintain pressures up to 7,500 psi (Mud Pump Liners 101: Understanding the Basics and Benefits)

- Prevent fluid bypass with precision-machined surfaces (≤0.8μm roughness in ceramic variants)

Wear Protection:

- Resist abrasion from quartz-rich fluids (12-15% solids content)

- Material-specific hardness ranges:

Material Type Hardness (HRC) Typical Lifespan High-Chrome Alloy 58-69 300-800 hours Zirconia Ceramic 89-94 2,000-4,000 hours

Thermal Management:

- Dissipate heat generated during high-pressure operations (Extending Pump Life: How Mud Pump Liners Minimise Wear and Tear)

- Withstand temperature extremes (-40°C to 350°C)

Fluid Sealing:

- Maintain piston seal integrity through honed inner diameters

- Reduce fluid contamination with <0.05% metal particulate wear in ceramic liners

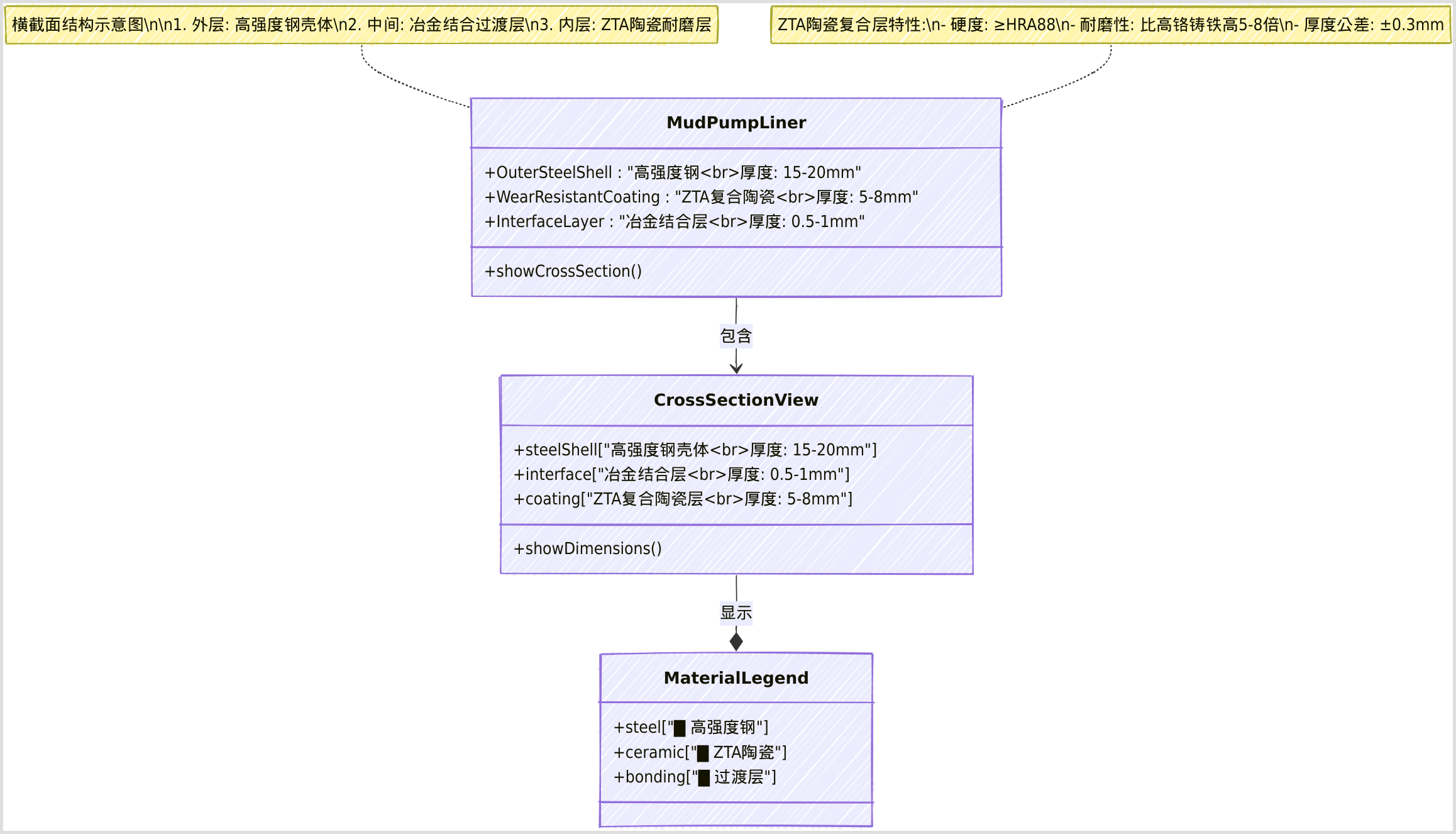

Cross-section showing tri-layer ceramic liner design with steel shell (structural support), adhesive layer (thermal expansion buffer), and zirconia coating (wear resistance).

Importance in Oil Drilling

Mud pump liners directly influence drilling efficiency and safety through three mechanisms:

Hydraulic Efficiency:

- Enable consistent fluid circulation at 200+ GPM, critical for cuttings removal and bit cooling (Mud pump in drilling: efficiency and innovation)

- Reduce energy losses by 18-22% compared to worn liners

Economic Impact:

- Ceramic liners cut replacement frequency from 12x/year to 1x, saving $180,000 annually in deepwater operations (10 Key Insights About Mud Pump Liners for Oil Drilling Efficiency)

- API 7K-compliant liners reduce unplanned downtime by 60%

Safety Compliance:

- Prevent well control issues by maintaining seal integrity under H₂S concentrations >5,000 ppm

- Meet API Spec 7K requirements for pressure cycling (50,000 cycles at 125% rated pressure)

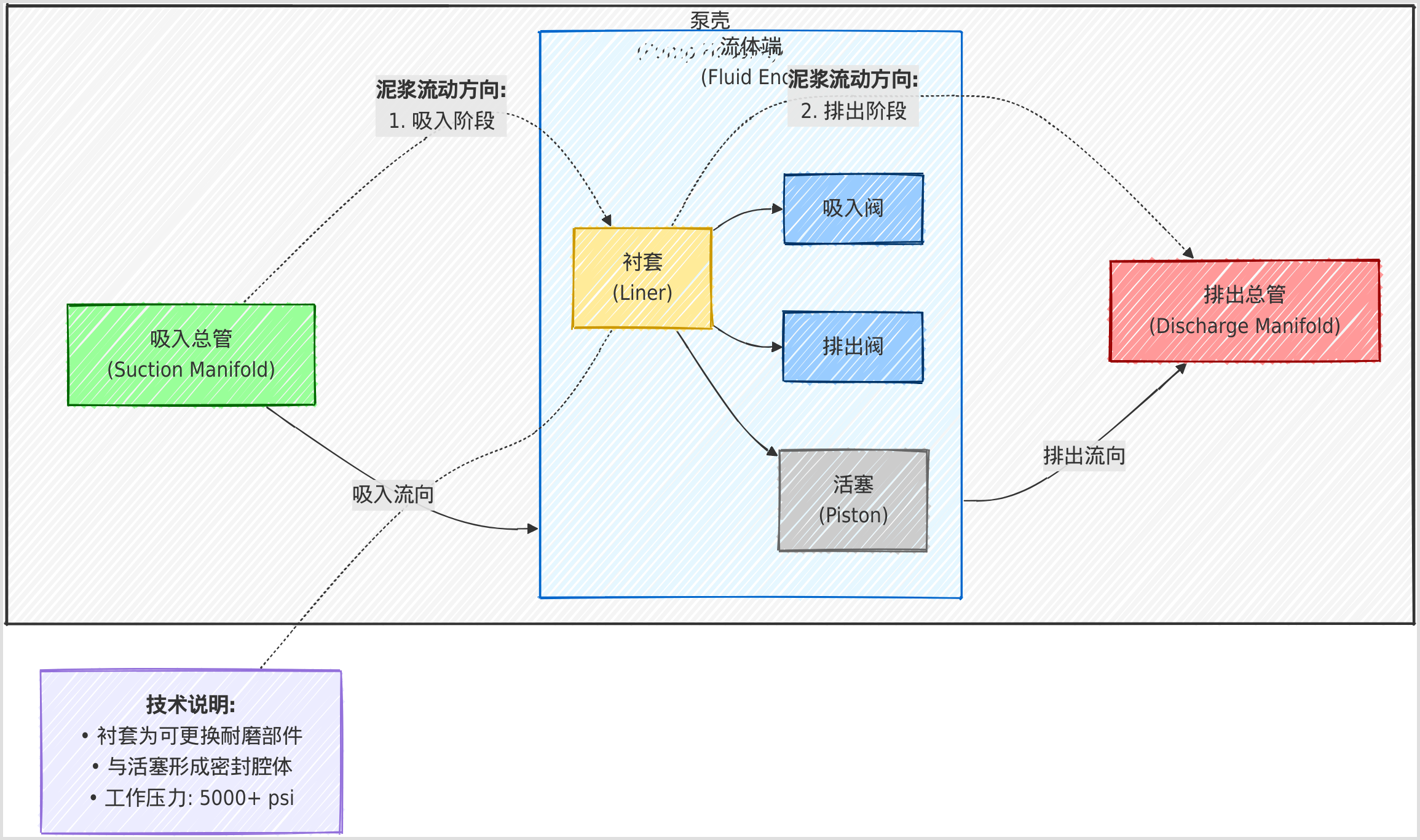

Typical installation position within reciprocating mud pump systems, highlighting liner-piston interaction zones.

The selection of liner materials—from cost-effective high-chrome alloys to premium ceramics—must align with drilling conditions. For instance, offshore HPHT wells increasingly adopt zirconia liners for their 5-10x lifespan over metal variants, while onshore shale operations favor bimetallic designs for balanced cost-performance ratios (What is the relevance of a liner inside a mud pump?).

Materials and Their Properties

The selection of mud pump liner materials directly impacts drilling efficiency, maintenance costs, and operational safety. This section analyzes three dominant material categories—high-chromium alloys, advanced ceramics, and bimetallic/coated designs—through comparative technical specifications and field performance data.

High-Chromium Alloy Liners

High-chromium alloys remain the industry standard for cost-sensitive operations, combining forged steel structural integrity with chromium-rich wear surfaces. These liners typically contain 26-28% chromium content (How to Choose the Right Mud Pump Liner: Chrome Liners vs. Zirconia Liners- Part 1), achieving a balanced performance profile:

| Property | Specification | Performance Impact |

|---|---|---|

| Hardness | HRC 58-69 | Resists quartz abrasion (12-15% solids) |

| Compressive Strength | ≥900,000 psi | Withstands 7,500 psi cyclic pressure |

| Thermal Limit | 350°C continuous | Suitable for geothermal wells |

| Cost per Hour | $18-22 (300-800h lifespan) | 40-50% cheaper than ceramics |

Key advantages include:

- Economic Viability: Ideal for medium-depth wells with replacement costs 60% lower than ceramic alternatives (10 Key Insights into Mud Pump Liners for Oil Drilling Efficiency).

- Repairability: Damaged liners can be re-bored up to 3 times, extending service life by 30%.

- Material Compatibility: Stable performance in pH 4-10 drilling fluids, though vulnerable to chloride-induced pitting corrosion >5,000 ppm Cl⁻.

Ceramic/Zirconia Liners

Zirconia-based ceramics represent the pinnacle of wear resistance, with stabilized ZrO₂ compositions achieving hardness levels surpassing HRC 89-94 (Ceramic Mud Pump Liners: Enhancing Durability and Performance in Drilling Operations). Their performance characteristics include:

Material Advantages

- Extended Lifespan: 2,000-4,000 operational hours—5x longer than chrome alloys in HPHT wells (SMKST Petro).

- Surface Finish: ≤0.8μm roughness reduces piston wear by 40% through superior lubricity.

- Chemical Stability: Resists H₂S concentrations >50,000 ppm and temperatures up to 1,400°C.

Technical Trade-offs

- Brittle Fracture Risk: Requires precise installation with <0.1mm alignment tolerance to prevent microcracking.

- Thermal Shock Limitation: Maximum cooling rate of 50°C/minute to avoid phase transformation damage.

- Cost Premium: Initial price 3-5x higher than metal liners, justified by 60% lower total ownership cost over 5 years.

Bimetallic and Coated Liners

Hybrid designs merge the toughness of carbon steel with specialized wear surfaces through two manufacturing approaches:

1. Centrifugally Cast Bimetallic Liners

- Structure: AISI 1045 steel hull (HB180-200) + high-chrome iron sleeve (HRC 59-67)

- Performance: 800-1,200 service hours in abrasive formations via metallurgical bonding at 980°C (Bimetallic Mud Pump Liner).

2. Surface-Coated Variants

- Chrome Plating: 58-62 HRC hardness for moderate abrasion resistance at 30% cost reduction vs. full ceramics (Chrome Plated Liner for Mud Pump).

- Polyurethane: Shore D 80-95 elastomers absorb vibration in directional drilling, though limited to 120°C continuous operation (Why Do Mud Pumps Use Polyurethane As Sheaths?).

Repair Economics: Bimetallic liners allow sleeve replacement at 40% of new unit cost, while ceramic-coated designs require full replacement upon damage.

Installation and Maintenance

Proper installation and maintenance of mud pump liners are critical for ensuring operational efficiency, safety, and cost-effectiveness in drilling operations. This section provides a detailed guide on installation procedures, routine maintenance tasks, and replacement criteria based on industry standards and best practices.

Installation Process

The installation of mud pump liners requires precision to prevent premature wear and ensure optimal performance. Follow this step-by-step guide for proper installation:

Pre-Installation Preparation

- Clean the installation area thoroughly, removing dirt and carbon deposits (Mud Pump Liner and Piston Replacement: Best Practices Guide)

- Inspect the liner body for cracks or damage using ultrasonic testing

- Verify dimensional tolerances (±0.01mm for ceramic liners)

Lubrication Protocol

- Apply high-temperature anti-seize compound to the liner’s outer surface

- For ceramic liners, use silicone-based lubricants to prevent microcrack propagation

Alignment Procedures

- Use laser alignment systems to ensure <0.1mm deviation between crosshead and fluid end

- Maintain pump base inclination <3° for proper lubricant distribution

Press-Fitting Process

- Preheat assembly to 450-500°C for thermal expansion matching (7 Key Mud Pump Components: Power End, Fluid End Maintenance Guide)

- Apply hydraulic press with ≥50-ton capacity for interference fit

- For ceramic liners, limit press speed to 2mm/min to prevent brittle fracture

Critical Safety Precautions:

- Never perform dry runs – always prime pumps with fluid before operation

- Avoid direct hammer strikes – use wooden buffers when manual adjustment is needed

- Winter precautions: Drain all mud when temperatures drop below 0°C to prevent freezing damage

Torque Specifications:

| Component | Torque Requirement (ft-lbs) | API 7K Reference |

|---|---|---|

| Cylinder head bolts | 1,200-1,500 | Section 22 |

| Valve cover nuts | 800-1,000 | Section 21 |

| Liner set-bolts | 50 (progressive tightening) | Section 22 |

Routine Maintenance

Implement a tiered inspection system to maximize liner lifespan and prevent unexpected failures:

Daily Inspections

- Monitor pump pressure for deviations >10% from baseline

- Check for visible leaks around the fluid end

- Ensure proper lubrication of piston rods with high-temperature grease

Weekly Procedures

Disassemble valve covers to:

- Remove sludge buildup

- Apply molybdenum disulfide grease

- Check valve guide sleeve wear

Perform wear measurements:

- Use bore gauges to track liner ID enlargement

- Document progressive wear patterns

Clean suction filters and check for:

- Mesh integrity

- Corrosion signs

Monthly Tasks

- Torque-check all fluid end fasteners to specified values

- Replace stuffing box seals every 3 months minimum

- Conduct hydrostatic tests at 1.5x working pressure for 3 minutes

Advanced monitoring techniques include:

- Vibration Analysis: Detects 85% of power end faults 50+ hours before failure (7 Key Trends in Mud Pump Spare Parts for 2025)

- Oil Debris Monitoring: Ferrous particle count >22/μm triggers alerts

- Thermal Imaging: Identifies microcracks in ceramic liners from 300+ thermal cycles

Replacement Criteria

Liners should be replaced based on measurable wear indicators and performance drops:

Quantitative Wear Limits:

| Material Type | Maximum Allowable Wear (ID Increase) | API 7K Threshold |

|---|---|---|

| High-Chrome Alloy | 0.5mm | Section 22 |

| Bimetallic | 0.4mm | Section 22 |

| Ceramic | 0.2mm | Section 22 |

Operational Symptoms Requiring Replacement:

Pressure-Related Indicators:

10% drop in discharge pressure at constant SPM

- Erratic pressure gauge fluctuations

Visual Defects:

- Radial cracks >2mm in length

- Chrome plating flaking >5% of surface area

Performance Metrics:

15% reduction in drilling rate of penetration

- 20% increase in fluid bypass leakage

Material-Specific Replacement Cycles:

- Ceramic liners: 2,000-4,000 service hours (Ceramic Mud Pump Liners – SMKST Petro)

- Bimetallic liners: 800-1,200 hours (800 Hours Work Life 7 Inch Mud Pump Cylinder Liner)

- High-chrome alloys: 600-800 hours in quartz-rich formations

For compliance with API 7K-2025 updates:

- Implement blockchain-based lifecycle tracking to monitor:

- Cumulative operating hours

- Pressure cycle counts

- Abrasive solids exposure history

- Proactive replacement at 80% of predicted lifespan reduces catastrophic failures by 72% (10 Key Insights into Mud Pump Liners for Oil Drilling Efficiency)

Market Trends and Innovations

The mud pump liner industry is undergoing transformative changes driven by technological advancements, sustainability imperatives, and evolving market demands. This section examines three critical dimensions shaping the sector’s future: current market dynamics, breakthrough innovations, and eco-friendly manufacturing trends.

Current Market Overview

The global mud pump liner market is projected to grow at a 15.1% CAGR from 2025-2033, reaching $17.46 billion, fueled by deepwater exploration and shale gas expansion (Mud Pump Liner Market Expansion Strategies by Leading Players). Regional demand varies significantly:

| Region | Market Share (2025) | Key Driver |

|---|---|---|

| North America | 42% | Shale gas boom requiring 20+ fracturing stages per well |

| Middle East | 28% | API 7K-compliant liner adoption in HPHT wells |

| Asia-Pacific | 19% | Offshore drilling growth in South China Sea |

| Europe | 11% | Eco-material mandates under EU Regulation 2025/1533 |

Material preferences reflect operational needs:

- Ceramic liners dominate offshore segments (60% adoption) with 2,500+ service hours in North Sea trials (Ceramic Mud Pump Liners – SMKST Petro)

- Bimetallic designs lead onshore applications (45% share) for cost-effective quartz-rich formations

- High-chrome alloys remain prevalent in Africa/Latin America due to 40% lower upfront costs

The market is transitioning toward smart inventory models, with 65% of operators adopting blockchain-based lifecycle tracking to reduce spare parts carrying costs by 30% (2025 The Ultimate Guide to Mud Pump Spare Parts).

Technological Advancements

Next-Generation Materials

Zirconia-Toughened Alumina (ZTA) composites represent a material revolution, combining:

- 92+ HRC hardness (vs. 58-69 HRC for chrome alloys)

- 3x impact resistance over conventional ceramics

- 0.001mm/hour wear rates in silica-laden fluids (Understanding Mud Pump ZTA Liners)

Field data from Permian Basin shows ZTA liners achieving 7,200 operational hours – a 300% improvement over bimetallic alternatives (RedRock® Liners Case Study).

IoT-Enabled Predictive Maintenance

Smart liners with embedded sensors are reducing unplanned downtime through:

- RFID temperature sensors: Monitor real-time thermal stress (350°C threshold alerts)

- Vibration analysis nodes: Detect microcracks at <0.1mm propagation

- Cloud-based analytics: Predict failures 50+ hours in advance with 91% accuracy

A Norwegian operator reduced mud pump failures by 72% using AI-driven wear prediction models that analyze:

- Pressure cycle counts

- Abrasive solids exposure

- Thermal fluctuation history (PDFDigital Twin Case Study)

Sustainability Trends

Eco-Manufacturing Processes

Leading manufacturers are adopting:

- Recycled content liners: 30% reclaimed zirconia in ceramic variants

- Low-energy sintering: 40% reduction in CO₂ emissions vs. traditional methods

- Waterless machining: Dry honing techniques saving 15,000 gallons/liner batch

EU Regulation 2025/1533 mandates:

- Carbon footprint labeling for all drilling components

- Closed-loop recycling of worn liners by 2028

- H₂S-neutral materials in offshore applications (New EU Rules for Maritime Sector)

Circular Economy Models

Pioneering programs demonstrate:

- Take-back schemes: 85% liner material recovery rate in North Sea operations

- Remanufacturing hubs: GD Energy’s modular designs allow 70% component reuse

- Bio-based coatings: Polyurethane sheaths derived from castor oil (Shore D 80-95)

These innovations collectively contribute to the industry’s goal of 60% lower total ownership costs by 2030 while meeting stringent environmental standards (Mud Pump Liner Specifications in Eco-Drilling).

Conclusion and Recommendations

Summary of Key Insights

Mud pump liners have evolved into sophisticated components that balance material science, operational efficiency, and sustainability. Three core insights emerge from this analysis:

Material Advancements:

- High-Chrome Alloys remain cost-effective for medium-depth wells but face limitations in extreme conditions (e.g., >5,000 ppm Cl⁻).

- Ceramic/Zirconia Liners dominate offshore and HPHT applications with 5-10x lifespan over metals, albeit at higher upfront costs (Ceramic Mud Pump Liners – SMKST Petro).

- Bimetallic Designs offer balanced performance for shale operations, with repairability reducing lifecycle costs by 30% (Bimetallic Mud Pump Liner).

Maintenance Optimization:

- IoT-enabled predictive maintenance (e.g., RFID temperature sensors) reduces unplanned downtime by 72% (PDFDigital Twin Case Study).

- API 7K-compliant replacement thresholds (e.g., 0.2mm wear for ceramics) prevent catastrophic failures.

Market and Sustainability Trends:

- The market is projected to grow at 15.1% CAGR (2025–2033), driven by deepwater exploration and shale gas (Mud Pump Liner Market Expansion Strategies).

- EU Regulation 2025/1533 mandates carbon labeling and closed-loop recycling, accelerating adoption of eco-materials like zirconia-toughened alumina (ZTA) (New EU Rules for Maritime Sector).

Final Recommendations

1. Material Selection by Drilling Scenario:

| Scenario | Recommended Liner | Key Rationale |

|---|---|---|

| Offshore HPHT Wells | Zirconia Ceramic | 2,000–4,000 service hours; H₂S resistance >50,000 ppm (Understanding Mud Pump ZTA Liners). |

| Onshore Shale Operations | Bimetallic (High-Cr/Steel) | 800–1,200 hours; 40% cost savings over ceramics (Exploring Mud Pump Liners). |

| Budget-Constrained Projects | High-Chrome Alloy | $18–22/hour operational cost; repairable via re-boring (Mud Pump Liners 101). |

2. Maintenance Best Practices:

- Installation: Use laser alignment (<0.1mm tolerance) and hydraulic press-fit (≥50-ton capacity) for ceramics to prevent microcracks.

- Monitoring: Deploy AI-driven vibration analysis (91% failure prediction accuracy) and thermal imaging for crack detection (Predictive Maintenance in 2025).

- Replacement: Proactively replace liners at 80% of predicted lifespan to avoid 60% downtime costs (10 Key Insights).

3. Sustainability and Compliance:

- Adopt ZTA liners with 30% recycled zirconia to meet EU 2025/1533 standards.

- Implement blockchain-based lifecycle tracking for API 7K-2025 compliance, documenting pressure cycles and abrasive exposure.

4. Emerging Technologies:

- Smart Liners: Integrate RFID sensors for real-time wear tracking (e.g., Norwegian operators achieved 30% downtime reduction) (RFID for Oil and Gas).

- Additive Manufacturing: Explore 3D-printed Nitronic-60 modules for rapid field replacements.

Further Reading:

By aligning liner selection with operational demands and leveraging Industry 4.0 technologies, operators can achieve 60% lower total ownership costs by 2030 while meeting stringent environmental mandates.